TABA-AmCham issued a report titled “Turkey-USA Foreign Trade Investment Report 2019” that details about the investment opportunities in the USA for businesses in Turkey. The report shows that the key for success lies on the intelligent analysis of the incentives offered by the state and federal levels. Turkish-American Businessmen Association, TABA and American Chamber of Commerce underlined the importance of increasing exports to the USA in order to overcome economic slowdown for faster growth. The association underlined that Turkey had only 0.4 percent share in the total imports of the USA, and offered its advices to Turkish businesses for better performance in this region.

The right business plan

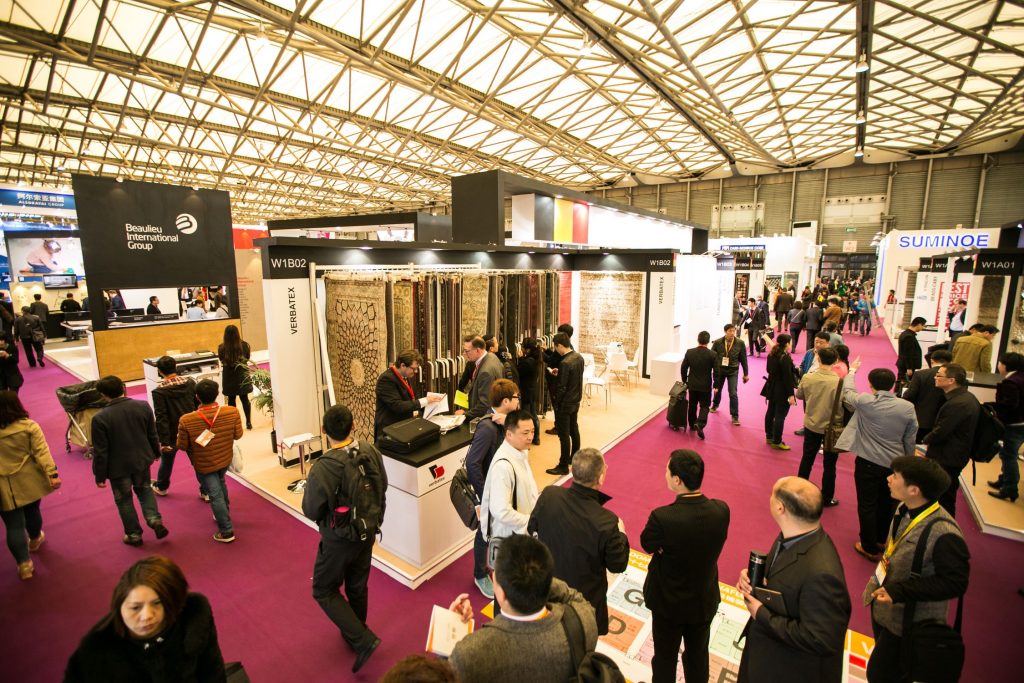

The report pointed out that the US was currently importing 2.6 trillion dollars and exporting 1.6 trillion dollars, and also mentioned the advantages of establishing businesses in the country. The report also stated that the major reasons for not being successful in the USA were the lack of a correct business plan, the desire to achieve results in a short time, the lack of human resources to compete in the foreign market and insisting on traditional promotional methods (fairs, exhibitions, etc.).

Access to finance

The report which stated that exports to the United States or establishing business there are also critical to branding and tries to find answers to the question, ”Why invest in the US”. It says, “Free trade agreements with 20 other countries provide opportunities to access hundreds of millions of additional consumers. The United States is also one of the best in the international arena for its ability to do business and access to finance, labor capability and protectionism. On the other hand, the country has rich resources, especially oil and gas.

The report explains the key points of success in the US:

Incenvites by state

- Short-term operations and long-term strategic plans for the market should be established.

- Since customer rights are well protected, logistics planning should be done in detail and quality should be given importance.

- Because commercial laws vary widely in federal, state and city basis, these services should be of high quality and well managed.

- Market / opportunity research findings and supply-demand structure should be analyzed in detail.

- Supply chains, brands and price strategies should be investigated in detail.

- Specific rules for the sector should be analyzed on the basis of state and federal laws.

- Incentives are one of the most important issues that vary from state to state. Some of these incentives are provided by state and some are covered by Federal incentives. These assignments should be studied well.

- Data and information on state basis, ‘tax relief’, ‘customs duty exemption’, ‘investment land allocation’, ‘educational support’, ‘financial support’ are important.

- Real estate tax reduction, income tax reduction and R&D support data are provided besides customs tax exemptions, insurance premium, employer share support and unemployment insurance discounts are made within the scope of federal incentives. These should be analyzed well.